But you need to remember to activate the bonus category every quarter to ensure you’re earning the 5% cash back.įor some people, the the Chase Freedom Unlimited still may make sense: The extra half-percent of rewards on non-bonus-category spending is consistent and can really add up over time. Because of the spending cap, your rewards on the rotating category max out at $75 each quarter before the rewards rate drops back down to 1%. Any given year, you can reasonably expect each to appear for one quarter. Some common 5% quarterly reward categories for the Chase Freedom Flex include Walmart and PayPal, gas stations, select streaming services and grocery stores.

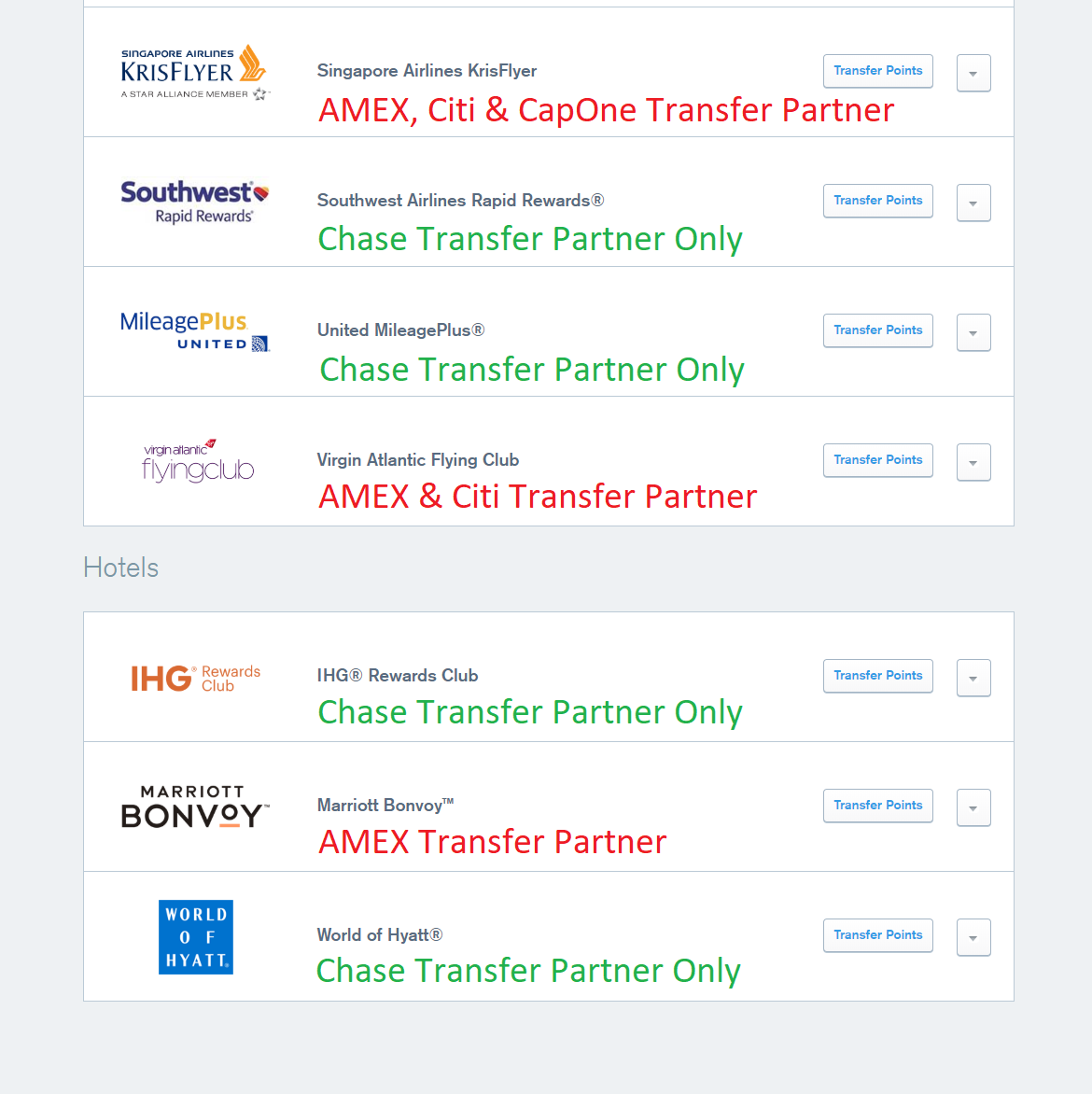

Winner: Chase Freedom Unlimited Comparing rewards Chase Freedom Unlimitedĥ% cash back on travel purchased through Chase Ultimate Rewardsĥ% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate Chase Freedom Unlimited: Earn a $200 bonus after you spend $500 on purchases in your first 3 months from account opening.Chase Freedom Flex: Earn a $200 bonus after you spend $500 on purchases in your first 3 months from account opening.That means neither card will gain any ground here. Welcome bonusesīoth Chase cards are able to earn the same welcome bonus. Both of these cards punch above their weight. It’s also worth noting many cards with no annual fee don’t offer as high of rewards rates - nor so many rewards categories. That can put consumers in a tricky spot if their spending habits or budgets change. While cards with $95 – $500 annual fees offer more rewards and perks, they require a certain amount of spending to make them worth it. Neither card charges an annual fee, which makes every reward you earn added value. To determine which is best for you, we’ve laid out the main differences and advantages of each below.

Chase dom plus rewards manual#

On the other hand, the Freedom Unlimited has a higher floor with its 1.5% cash-back rate on non-bonus-category spending, and doesn’t require manual intervention to maximize your rewards. But the Freedom Flex does require a little bit of work to activate the quarterly rewards categories and pay attention to what you’re buying.

The Chase Freedom Flex has a higher ceiling than the Freedom Unlimited, as it will net most people more rewards.

Their reward rates are comparable to more expensive, premium credit cards and cardholders don’t need to worry about points, miles or complicated redemption processes. The Chase Freedom Unlimited®* and the Chase Freedom Flex℠* are no-annual-fee rewards credit cards that offer excellent cash-back rewards rates across a handful of spending categories.

0 kommentar(er)

0 kommentar(er)